What are the different arbitrage strategies that are used?

Well, first of all, triangular arb isn’t what you call a “statistical arb”. Triangular arb is “pure arbitrage”, meaning that free money exists in a given time frame, assuming you can fill all three trades at once.

Statistical arbitrage, as the name indicates, is based on some kind of statistics. The word “arbitrage” get’s thrown around a lot and it doesn’t necessarily mean anything out of context.

Simplest thing is to assume that you have a co-integration between two instruments, say A and B. You believe A is relatively overvalued and/or B is relatively undervalued. Therefore you short A and/or go long in B, expecting them to converge over time. Depending on your strategy, parameters or instruments, that may take seconds, hours, days or weeks to happen.

A/B can be literally anything, so just from the top of my head:

- Silver futures vs silver miners. One can expect that the price of silver and silver miners earnings (and therefore stock price) are correlated.

- Old crop / new crop futures spread in wheat. You can look at the historical price difference between last futures before the crop and first month after the crop has arrived.

- LIFFE vs MATIF wheat futures have different specifications. You can look at the historical relation and if the price difference diverges to some significance, you’ll take a position expecting it to revert.

- “Upstream/Downstream” and Crack spreads. Oil refineries don’t care about price of oil and distillates as much as they care about their profits. So you’d expect them to hedge their “crack spread” and you can take positions, expecting it to revert to some certain level when it’s too out of whack. Read more here – Crack spread

- .

- Pepsi (PEP) vs Coca-Cola (KO) stocks. Similar companies, similar business etc. One would expect that the companies should be valued somewhat similarly, unusual circumstances set aside.

- This can go into a form of index arbitrage as well. One set/basket of stocks against an index or a sector. Financial sector vs SPX, consumer discretionary vs cons staples, Wells Fargo Bank vs Financial sector.

- Equities (S&P500 index) vs Volatility (reversed). One might think that out of the earnings season, rising equity markets mean lower volatility and vice versa. You can throw government yields, credit or whatever in the list, as long as it’s something macro.

- Volatility arbitrage is basically a statistical arbitrage as well. You’ll have a delta neutral option portfolio against the underlying.

- Credit arbitrage, basis arbitrage etc.

There are literally millions of possibilities, these were just the few that popped into my mind. Some of them aren’t available for retail investors, some of them are too insignificant for “big boys” to chase.

Then there are ways to exploit a correlation or a co-integration when you can trade only one instrument. From the top of my head – how do sun activity and corn crop correlate? Can you predict anything which is statistically significant?

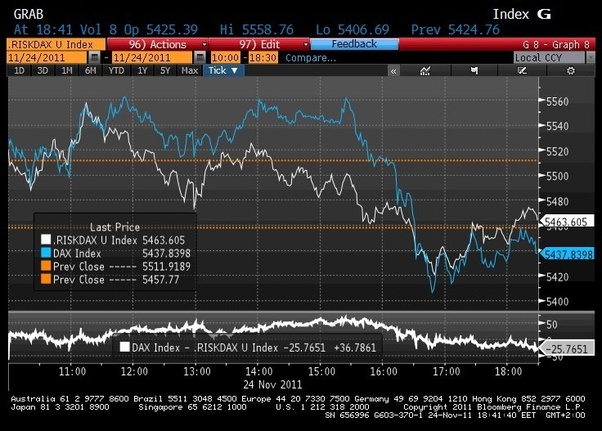

I’ll give a more realistic example: I’ve traded DAX30 index (via options or futures) based on a model of other risk assets (it’s old enough now to share). Basically there is a model consisting of macroeconomic factors that should indicate the “fair value” of DAX30 index intraday. On this graph: during the mid-day the index was levitating higher than the model indicated on a low volume, so there existed an opportunity to short. There you have it – “statistical arbitrage” based on some statistics and needs some time to pass in order to work. What goes into the model, how is it calculated, how do you test it before you put anything on the line etc is up to you to figure out. I’m just giving a sample.

Then there are some forms of “pure arb” which exist for longer time periods than few nanoseconds until HFT guys clear that. PTM and PGM are both basically platinum ETFs. Sometimes they are out of whack for no apparent reason: